$516K Saved: Avoiding the Trap of Early-Stage Last-Resort Lending

Client Background

After doubling revenue to a $30 million run rate, this early-stage staffing startup had outgrown its small CPA firm. Its basic tax and bookkeeping services could no longer keep pace with the company’s financial complexity, so the company turned to us for help.

The Challenge

Despite impressive revenue growth, the company faced persistent cash flow strain driven by the working capital requirements, low operating margins, and slow cash conversion cycle typical of the staffing industry. To cover short-term needs, they relied on an ultra-high-cost factoring arrangement that quietly eroded profits. Compounding the issue, the factoring fees weren’t visible in the financial statements; they were netted against revenue by the prior CPA, leaving ownership blind to the true cost of capital and the scale of profit loss.

Our Approach

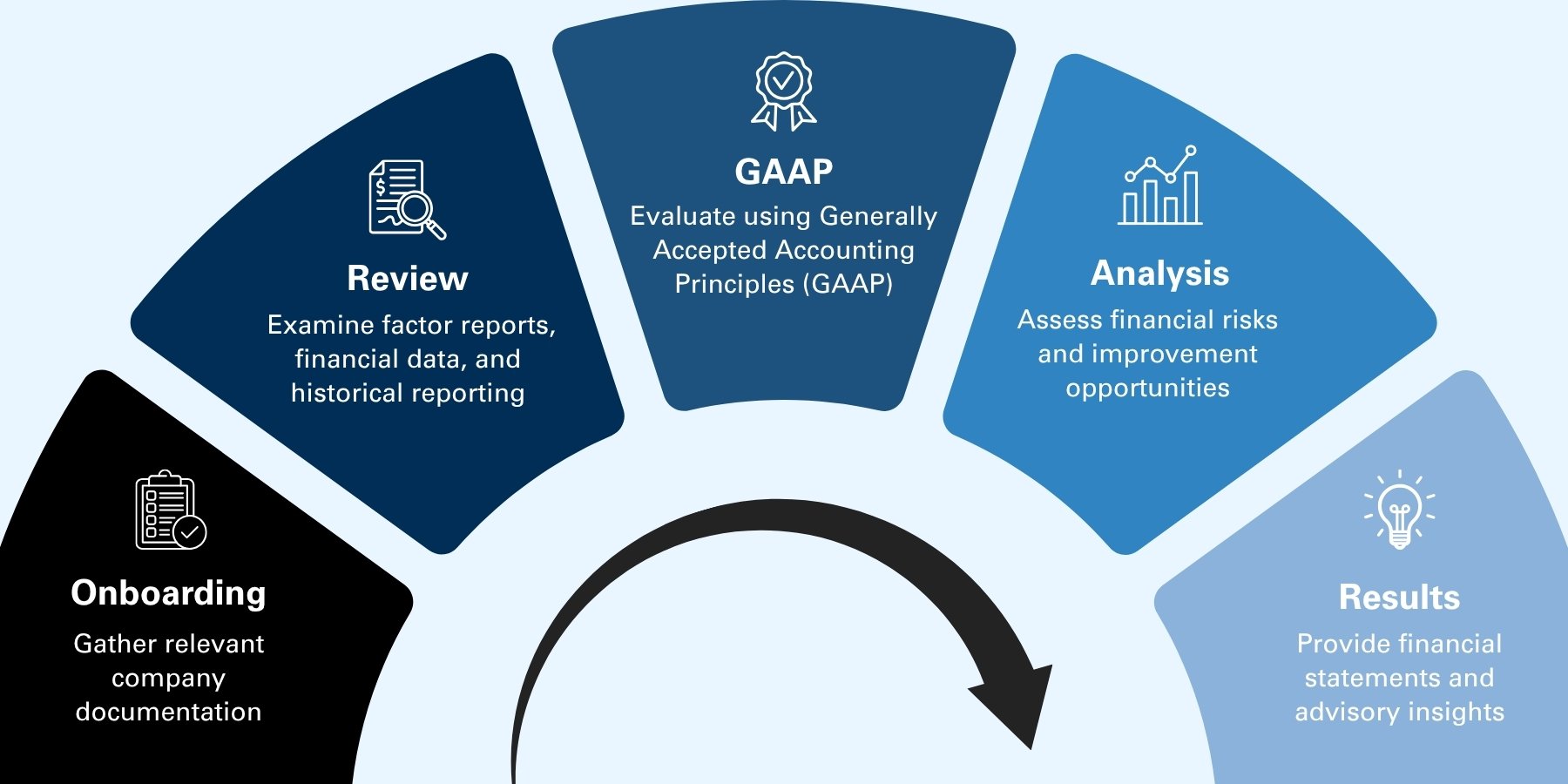

As part of our onboarding, we conducted a thorough review of factor reports, financial data, and historical reporting practices. We analyzed the company’s financials against GAAP standards and identified discrepancies in how financing costs were reported and disclosed. Our analysis revealed the company was losing $693K annually in cash flow to financing costs far above market norms for a business of its size, maturity, and credit profile. We advised leadership on the true cost burden, redesigned the financial reporting structure to improve transparency, and introduced the company to a specialized lender offering a more favorable line of credit. We also implemented processes to meet the lender’s reporting requirements and maintain long-term financing compliance.

The Results

With the new credit facility in place, the company reduced annual financing costs to $151K and $177K over the next two years—saving $516K per year compared to its prior factoring arrangement. The company exited its legacy factoring relationship, which had been necessary in its earliest days but was no longer a fit for a business at its scale. Beyond the financial savings, ownership and management gained critical visibility into operating performance and financing costs, enabling more informed strategic decisions. Most importantly, the freed-up capital could now be redeployed into growth initiatives, fueling the next phase of the company’s expansion.