Capturing $231K in Tax Savings by Reevaluating State Apportionment

Client Background

A highly profitable natural resources company with over $20 million in annual revenue engaged us for tax services as they continued to scale. The business had previously worked with a large regional CPA firm for tax planning and preparation, but leadership turned to us for more advanced tax strategies and support.

The Challenge

After years of consistent profitability, the company was facing increasingly large annual tax bills. While they initially sought prompt and reliable tax services, leadership was also eager to explore strategies to reduce or defer their growing tax liability.

Our Approach

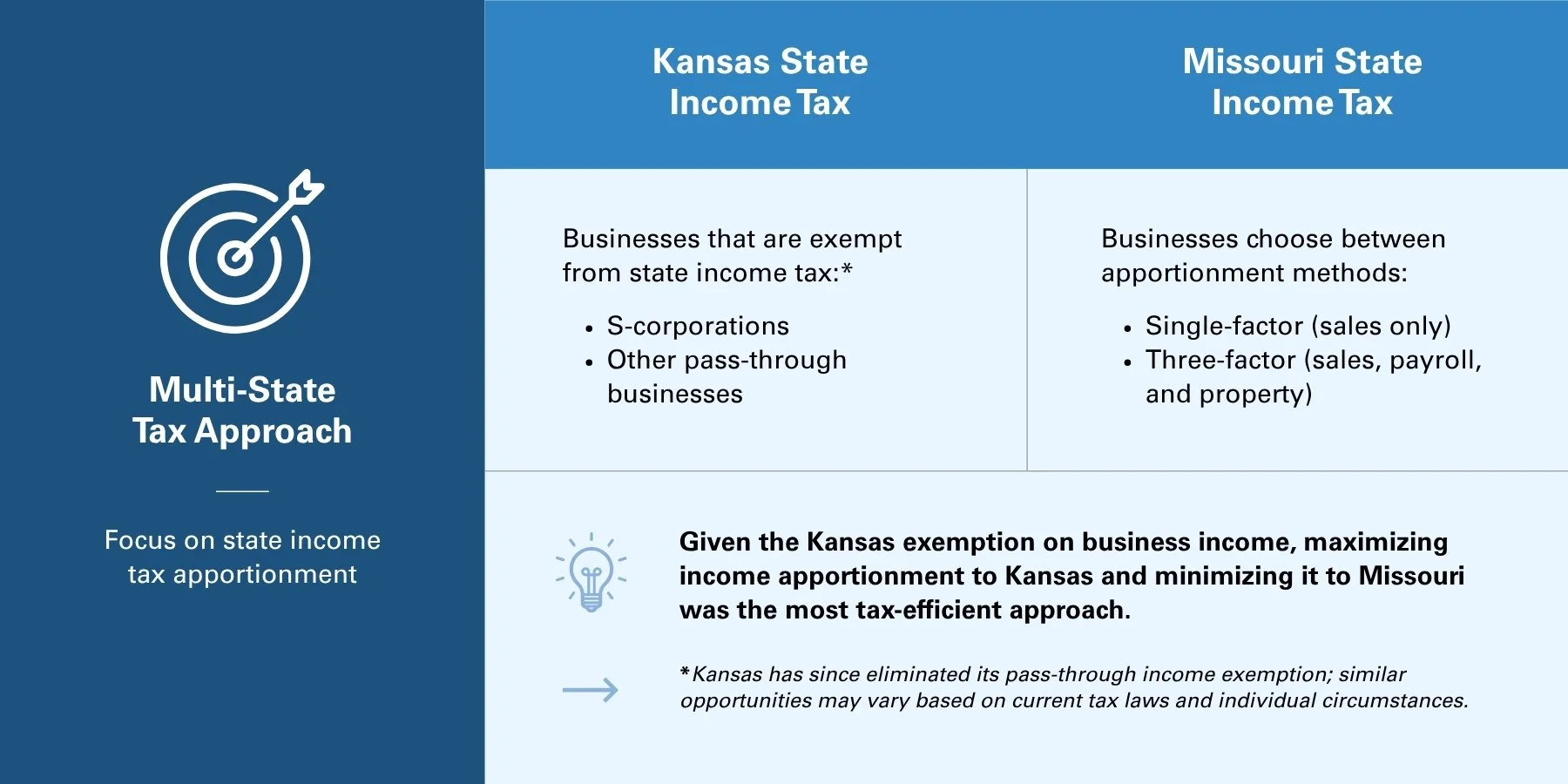

We take a strategic approach with first-year clients, reviewing the past one to two years of tax returns alongside preparing the current year’s filing. Our goal is to uncover missed opportunities—from amending past filings to adjusting elections or accounting methods—to optimize tax savings. In this case, our review revealed a significant opportunity related to state income tax apportionment. The company operated in both Kansas and Missouri, which are two states with notably different tax rules. At the time, Kansas exempted S-corporations and other pass-through businesses from state income tax, while Missouri allowed businesses to choose between single-factor (sales only) or three-factor (sales, payroll, and property) apportionment methods. With no tax on business income in Kansas, it was favorable to route as much taxable income to Kansas and as little to Missouri as possible. Although Kansas has since eliminated its pass-through business income exemption, other tax laws may offer similar opportunities depending on the company’s specific situation. Tax laws and business conditions also evolve continually, often creating new planning opportunities.

The Results

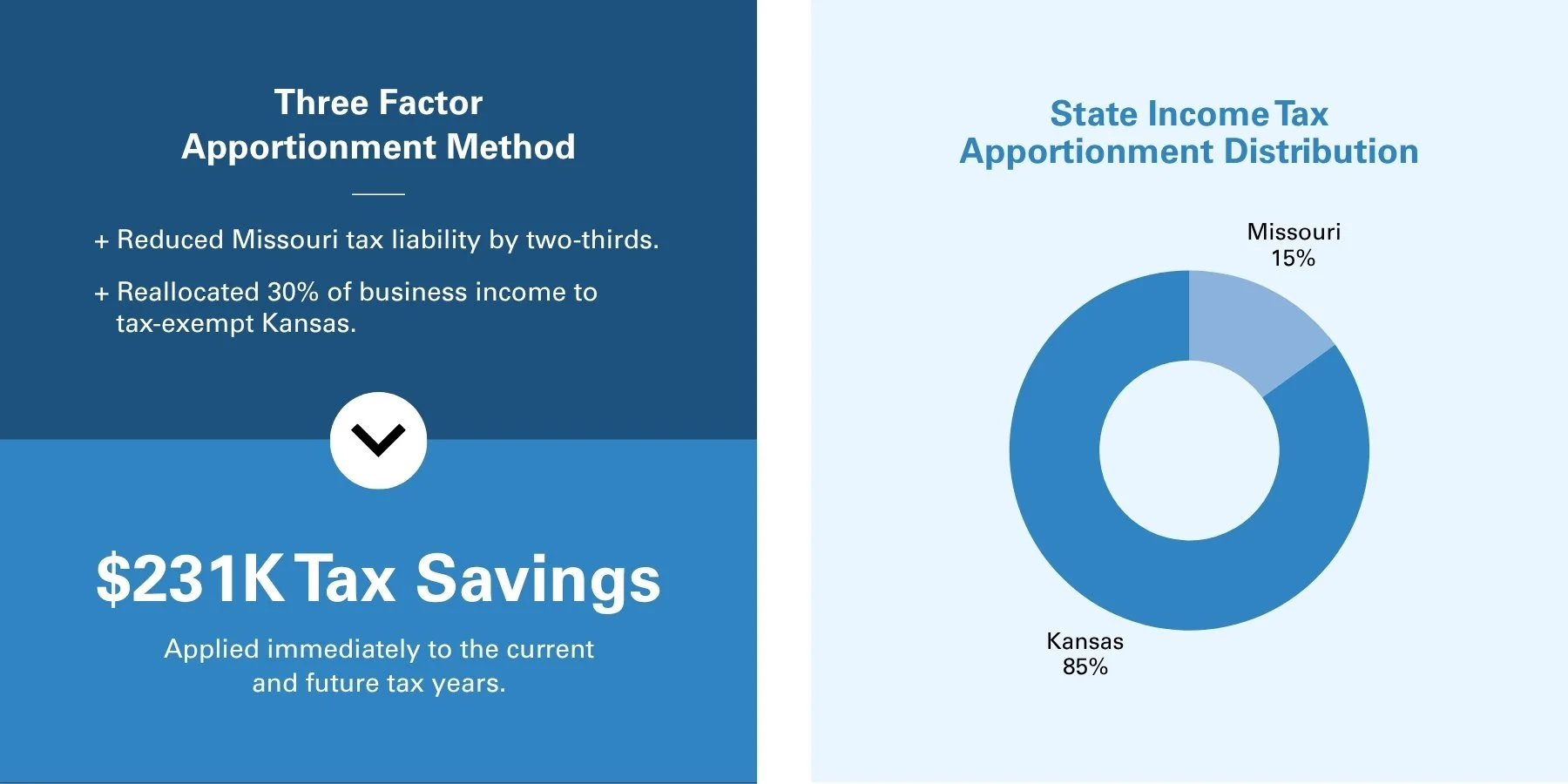

We quickly identified that the prior CPA had used single-factor apportionment, resulting in 45% of income being allocated to Missouri. By electing the more favorable three-factor method, we reduced Missouri’s apportionment share to approximately 15%, as the company had minimal payroll and property in the state. This shift effectively eliminated two-thirds of their Missouri tax liability and allowed them to route an additional 30% of income to tax-exempt Kansas. Although prior-year amendments weren’t allowed for apportionment method changes, the savings applied immediately to the current and future tax years and resulted in $231K of state tax savings in the year of adoption, with additional savings expected annually going forward.