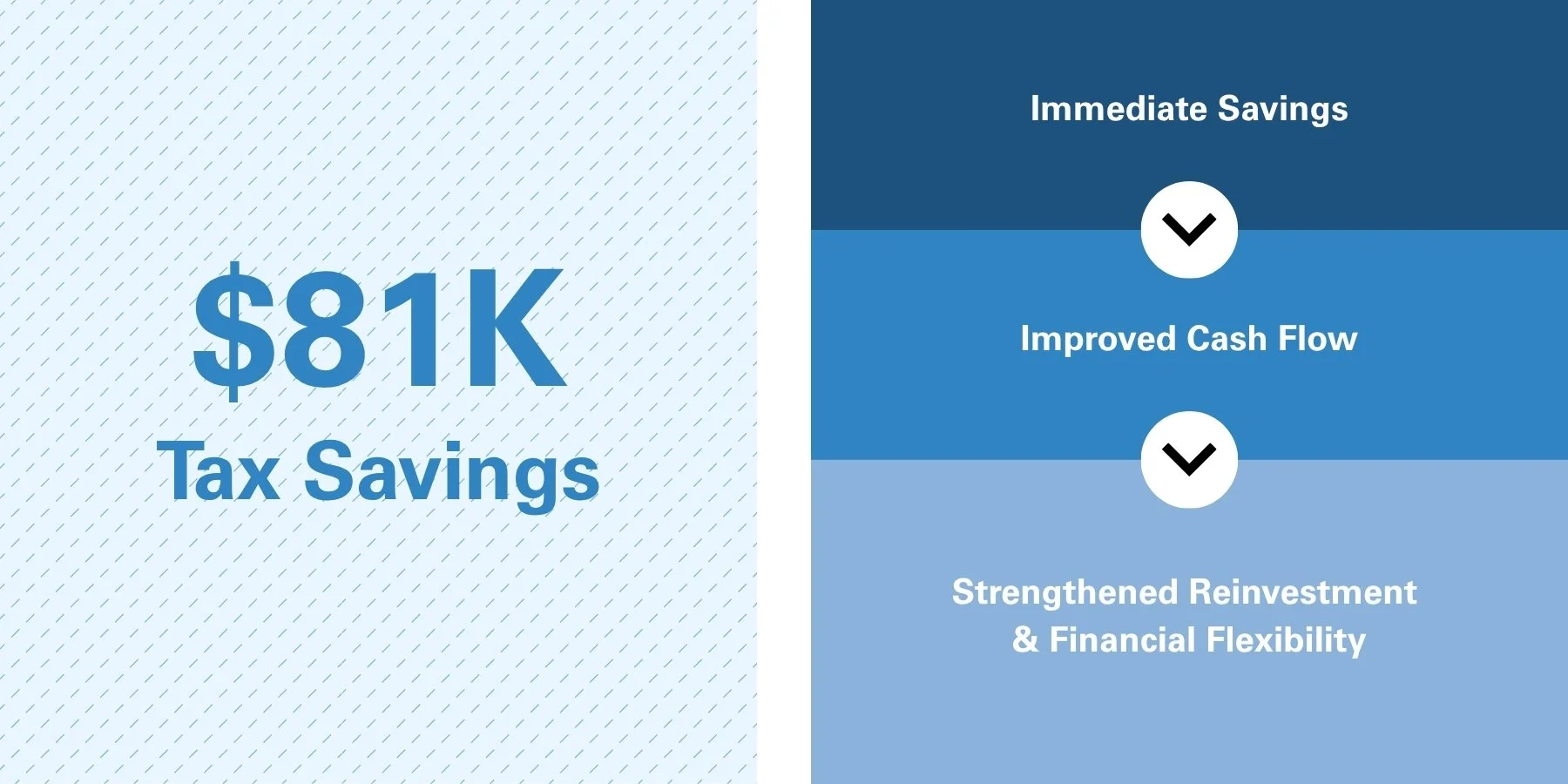

How We Unlocked $81K in Immediate Tax Savings for a Manufacturer

Client Background

We worked with an established manufacturing company that had recently acquired commercial real estate to house its offices and warehouse as part of a broader ownership transition.

The Challenge

The company was a consistently profitable manufacturer, but with success came sizable annual tax bills that strained cash flow. Following its acquisition of new commercial real estate, leadership was eager to explore all available tax strategies to minimize liabilities and maximize funds available for reinvestment.

Our Approach

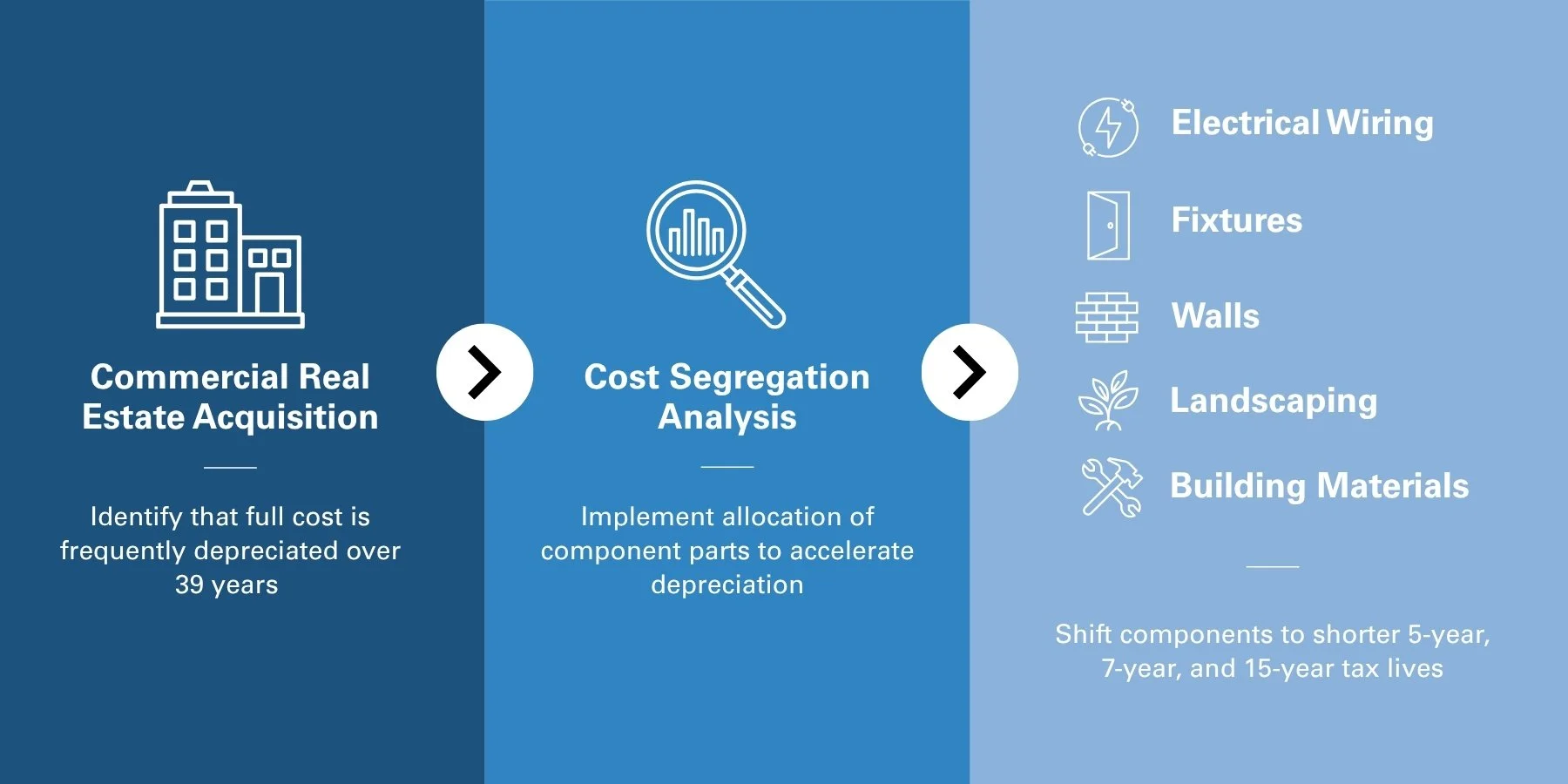

As part of our proactive tax planning process, we regularly assess opportunities stemming from new tax laws or business changes. The acquisition of new real estate presented an opportunity to segregate the costs of the building into component parts such as electrical wiring, fixtures, walls, landscaping, and building materials. While the full cost of commercial buildings are typically depreciated over 39 years, many of these components qualify for accelerated depreciation over 5, 7, or 15 years. By reallocating eligible costs to these shorter tax lives, we aimed to accelerate deductions and deliver near-term savings.

The Results

Our detailed cost segregation analysis unlocked $81,000 in net present value tax savings in the current year alone. Instead of waiting nearly four decades to fully realize depreciation benefits, the company was able to capture immediate savings to improve cash flow, strengthen reinvestment capacity, and enhance long-term financial flexibility.